50/30/20 Budget Calculator – NerdWallet

What is the 50/30/20 budget calculator?

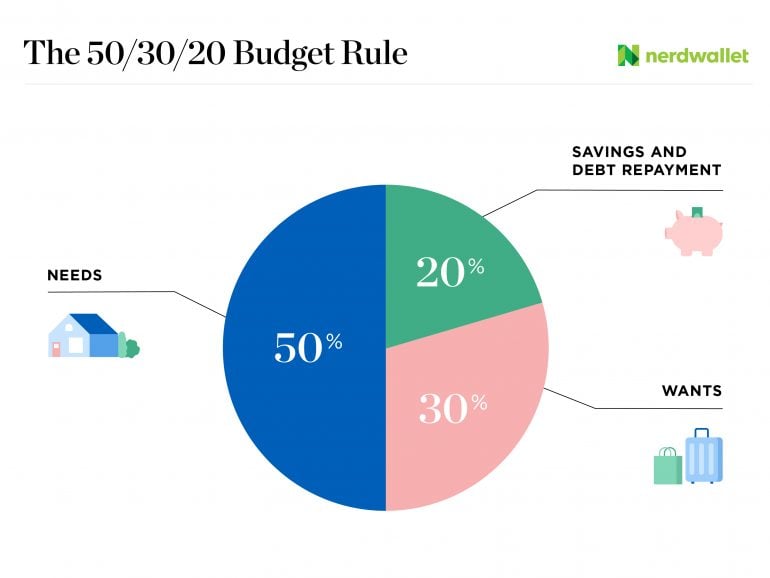

Use our 50/30/20 budget calculator to estimate how you might divide your monthly income into needs, wants and savings. The calculator is based on the 50/30/20 budgeting rule, which is a popular strategy used to help people manage their money. The smallest number, which is the 20%, is dedicated to debt repayment and savings. Once you achieve that, perhaps with an employer-sponsored retirement plan and other automated monthly savings transfers, the rest — that big 80% chunk — is up for debate.

That leaves 50% for necessities such as housing, food and transportation. The 30% goes to wants that are non-essential to living and working. Ultimately, these are parameters you can tweak to suit your reality. For example, if you live in an expensive housing market, your monthly mortgage or rent payment might spill a bit into your “wants” budget. Budgets are meant to bend but not be broken.

Earn up to $350 in rewards each year

With a Nerdwallet+ membership, it’s easy to rack up rewards for the smart financial decisions you’re already making.

How the 50/30/20 budget calculator works

Our 50/30/20 calculator divides your take-home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. You can also sign up for a free NerdWallet account to utilize our 50/30/20 budget breakdown and identify areas where you can save.

Find out how this budgeting approach applies to your money.

Savings and debt repayment

$0

Do you know your “want” categories?

Become a NerdWallet member to track your monthly spending trends, including how much you’re allocating to needs and wants.

What is the 50/30/20 rule?

The 50/30/20 rule is a popular budgeting method that splits your monthly income among three main categories. Here’s how it breaks down:

Monthly after-tax income

Before you can slice up your 50/30/20 budget, you need to calculate your monthly take-home income. This figure is your income after taxes have been deducted. It’s likely you’ll have additional payroll deductions for things like health insurance, 401(k) contributions or other automatic payments taken from your salary. Don’t subtract those from your gross (before tax) income. If you’ve lumped them in with your taxes, you’ll want to separate them out — subtract only taxes from your gross income.

50% of your income: needs

Necessities are the expenses you can’t avoid. This portion of your budget should cover required costs such as:

-

Minimum loan payments. Anything beyond the minimum goes into the savings and debt repayment bucket.

-

Child care or other expenses that need to be covered so you can work.

30% of your income: wants

Distinguishing between needs and wants isn’t always easy and can vary from one budget to another. Generally, though, wants are the extras that aren’t essential to living and working. They’re often for fun and may include:

20% of your income: savings and debt

How, exactly, to use this part of your budget depends on your situation, but it will likely include:

-

Saving for retirement through a 401(k) and perhaps an individual retirement account.

-

Paying off debt, beginning with high-interest accounts like credit cards.

A smart view of your financial health

Get a quick read on how you’re set up to meet expenses and money goals.

Get more help with monthly budget planning

link